Student Loan Calculator

Your Debt-Free Date

Loan Summary

| Loan | Balance | Interest Rate | Min Payment | Action |

|---|

If you continue making only minimum payments, you'll be paying on your loans until:

And you'll pay $ in interest.

But if you use the debt snowball method, you'll be student loan debt-free by:

And you'll pay $ in interest. That saves you $ in interest alone.

Boost your payments to pay off your student loans even faster!

What It Means: The interest rate is the percentage charged on your student loan balance annually. This rate affects how much you’ll owe in addition to the principal amount of your loan.

How to Answer:

- Enter the annual interest rate (APR) for your student loan. You can typically find this in your loan agreement.

- Ensure you’re entering the correct rate as even a small difference can significantly affect your total repayment amount.

What It Means: The minimum monthly payment is the smallest amount you are required to pay each month to avoid defaulting on your loan. It is calculated based on your loan balance, interest rate, and the repayment term.

How to Answer:

- Enter the minimum monthly payment required by your loan servicer. This ensures the calculator can accurately estimate your payoff schedule.

- If you're making larger payments than the minimum, you can add that to the "Extra Monthly Payment" field for more precise results.

What It Means: The extra monthly payment is an additional amount you pay each month on top of your minimum monthly payment. Paying extra reduces your loan balance faster and helps you save on interest.

How to Answer:

- If you’re planning to pay more than the minimum required each month, enter the extra amount you’ll pay here.

- This field is optional, but making extra payments can help you become debt-free sooner.

Breaking Free from Student Loans: Your Journey to Financial Freedom

Ah, student loans—the financial souvenir from your college days that keeps on giving, or rather, taking. We've all felt that pinch when the monthly statement arrives, wondering if we'll be tethered to this debt forever. But imagine a life where student loans are a thing of the past. Paying them off isn't just about eliminating a bill; it's about unlocking opportunities, reducing stress, and stepping confidently into your financial future.

Why Paying Off Student Loans Matters

Think of your student loans as that clingy ex who just won't take a hint. Once you finally part ways, you're free to focus on what truly matters: saving for a home, starting a business, or planning that dream trip to Bali. Eliminating student debt boosts your credit score, increases your disposable income, and gives you the freedom to make life choices without that financial ball and chain.

Budgeting: Your Secret Weapon

So, how do you bid farewell to your student loans sooner? Enter budgeting—the superhero of personal finance. Crafting a budget isn't about restricting joy; it's about making your money work for you. By tracking your income and expenses, you can uncover hidden spending (did someone say daily caramel latte?) and redirect those funds toward your loans. Small adjustments can lead to big payoffs over time.

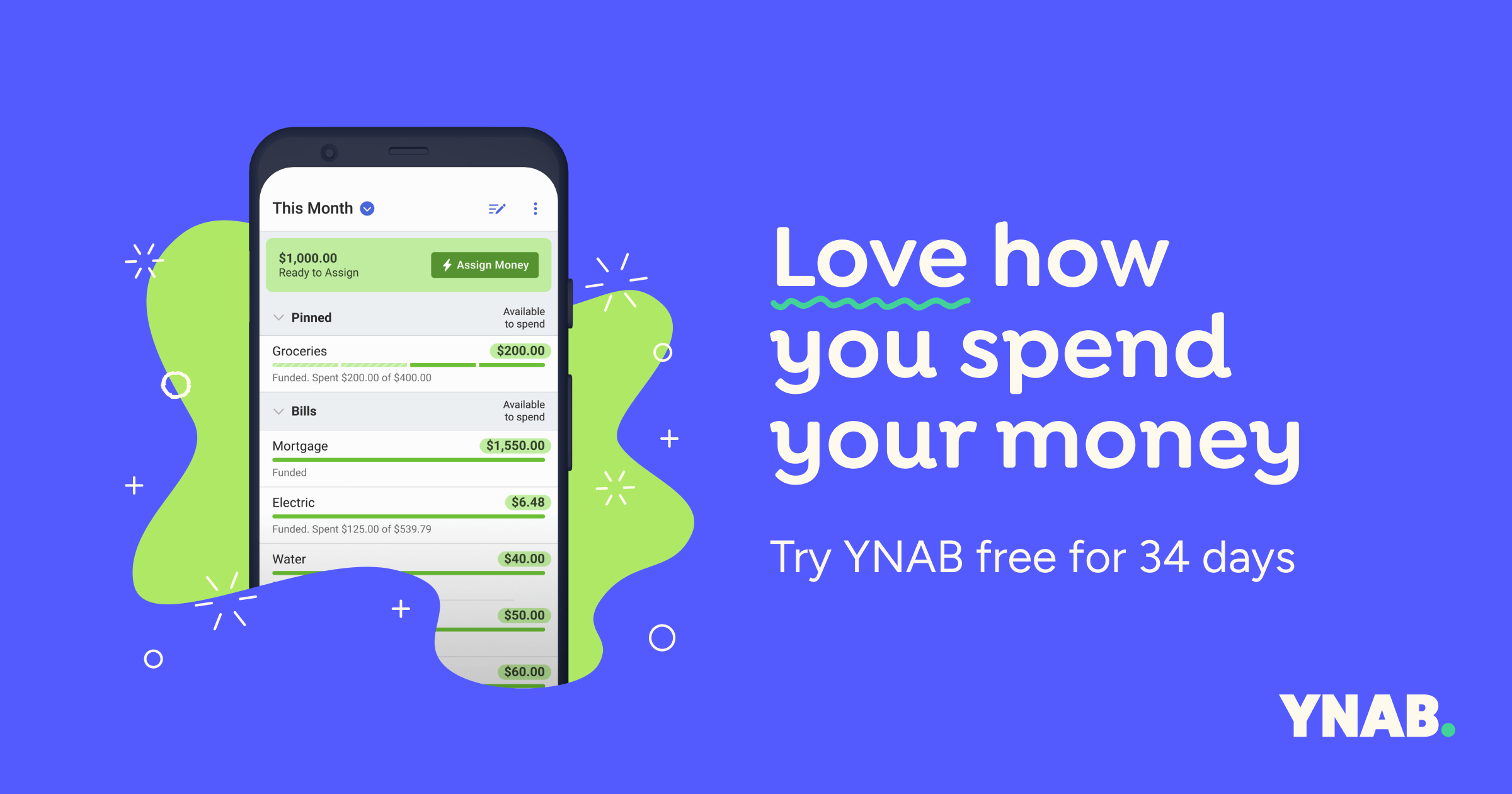

Meet YNAB: Your Budgeting Sidekick

Now, if budgeting sounds about as fun as watching paint dry, fear not! You Need A Budget (YNAB) is here to make the process engaging and effective. YNAB is like that friend who turns every chore into a party. It helps you monitor spending in real-time, set achievable financial goals, and anticipate upcoming expenses so there are no surprises. With its user-friendly interface and insightful tools, YNAB transforms budgeting from a tedious task into an empowering experience.

Start Your YNAB Journey

Start Your YNAB Journey

*This is an affiliate link. We may earn a commission at no additional cost to you.

Start Your Journey Today

Every epic adventure begins with a single step. By embracing budgeting and leveraging tools like YNAB, you're not just paying off student loans—you're paving the way to a financially free future. So why wait? Dive into budgeting bliss and watch as your debt diminishes and your dreams come into focus.